Getting Started

Environment Setup

Before you begin, make sure you have completed the Set Up Test Environment step.

| Test | https://pay-gate-uat.checus.com/aggregate-pay/api/gateway/<PATH> |

| Production | https://pay-gate-hk-prod.checus.com/aggregate-pay/api/gateway/<PATH> |

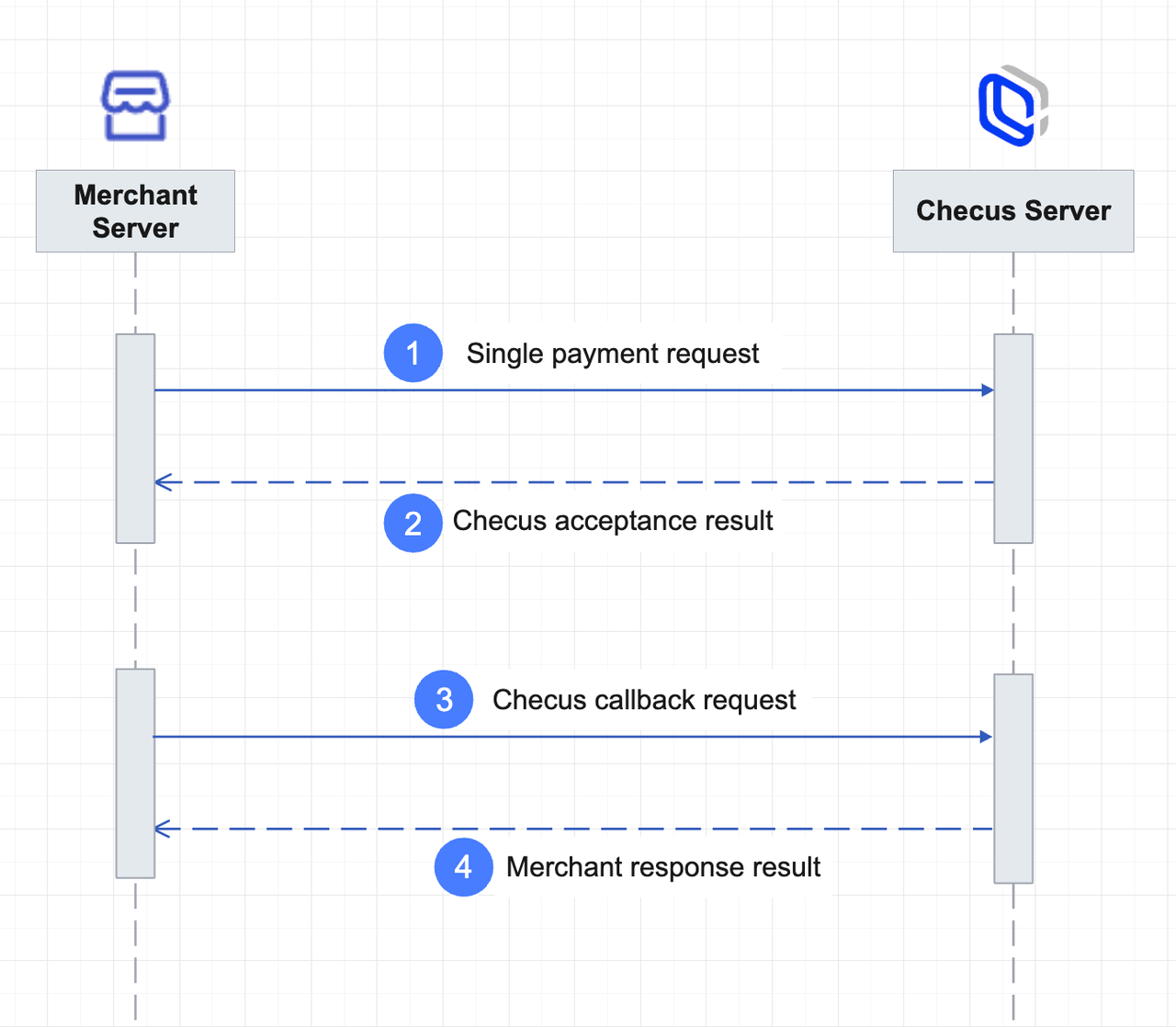

Interaction Flow

Key APIs

| Interaction | Direction | API / Method |

|---|---|---|

| Create payout request | Merchant → Checus | /paymentOrderPay |

| Payout result webhook | Checus → Merchant | /disbursementResultNotifyUrl |

| Query payout | Merchant → Checus | /paymentOrderQry |

Integration Steps

Before you start

- Download the payout application template and collect the user's payout details in your app or website.

- Construct request parameters according to the “Filling Rules” table in the Payout Application Template (fields with pink background are required).

- Payout requests are irreversible once submitted.

1. Create a payout session

Call Apply for Payout/paymentOrderPay with POST to create a payout.

Each order you submit must pass idempotency checks. Include a unique orderId in the request.

If Checus detects a duplicate orderId, it returns code=ORDER_REPEAT together with the current order status.

2. Obtain payout results

Method 1. Result notification

After processing, Checus calls your Payout Result Notification/disbursementResultNotifyUrl . It may retry multiple times until you return a successful response.

Callbacks usually occur when the transaction reaches a terminal state (e.g., Success, Failed, Bounceback); if the Processing state requires merchant/user awareness, a prior notification may be sent.

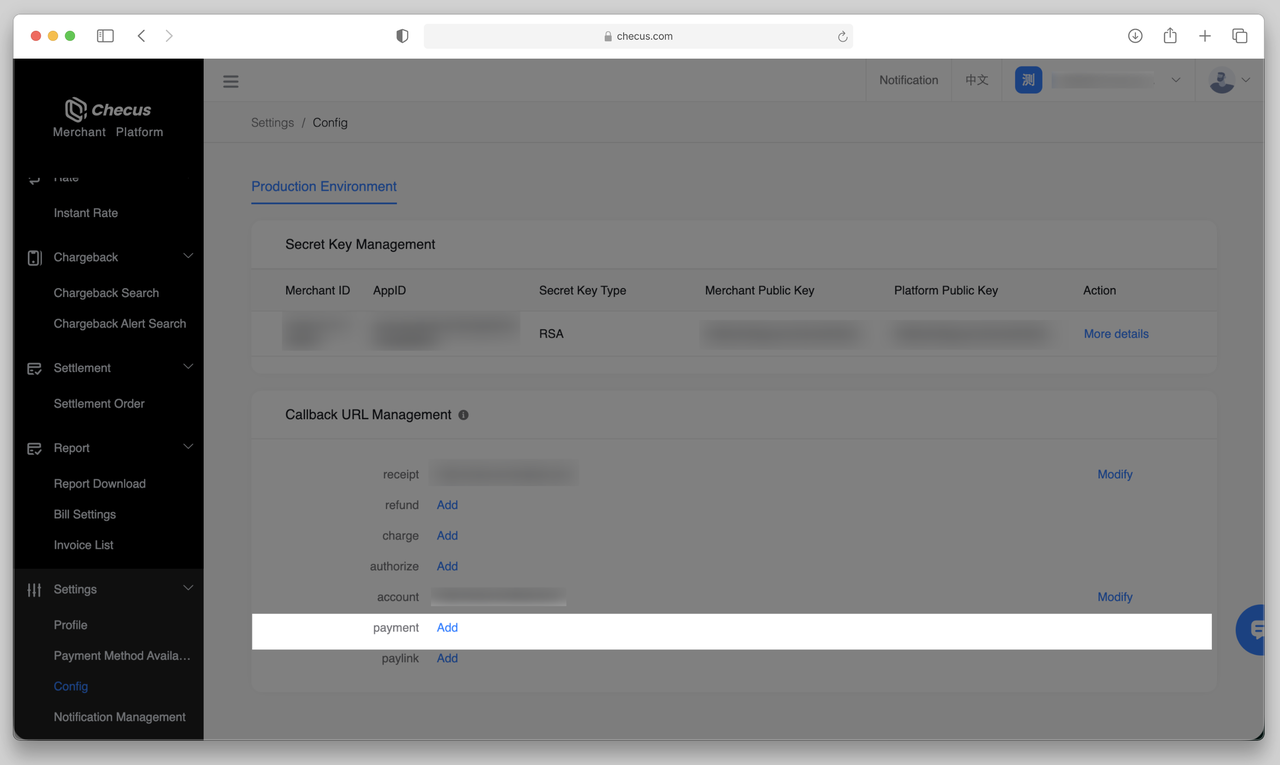

How to configure the callback URL:

- Pass via API: provide

notifyUrlin/paymentOrderPay, effective for the current order only; - Platform setting: configure a global callback URL in the Merchant Portal, applied to all orders.

Upon receiving the notification, you should return a processing result. If there is no response or a failure is returned, Checus retries at the following intervals: 0s / 30s / 300s / 600s / 3600s / 43200s, up to 6 retries.

Method 2. Proactively query the result

If no notification is received or the order status is unclear, call Payout Query/paymentOrderQry to obtain the result.

Use the response

codeto judge whether the query itself succeeded, and usedata.statusto determine the payout status.

Payout status list

2.1 Main status enum

| Status | Description | Guidance |

|---|---|---|

| SUCCESS | Payout succeeded | - |

| PENDING | Payout processing | 1. After submission the order enters PENDING until a terminal state (SUCCESS / FAILED / BOUNCEBACK). 2. Multiple situations may occur under PENDING; see sub-status section. |

| FAILED | Payout failed | Refer to Error Codes for causes |

| BOUNCEBACK | Funds returned | In some countries, financial systems may return funds after initially returning success due to reasons such as: – Invalid/frozen beneficiary account – Bank or clearing network issues The order status changes from SUCCESS to BOUNCEBACK, and funds are returned to the merchant account. |

2.2 Sub-status (for PENDING)

| Main Status | Sub-status | Description | Merchant guidance |

|---|---|---|---|

| PENDING | PEND_RFI_MATERIAL | Materials required | Financial system triggered review; submit supplementary materials. Check email/portal notifications and upload required files. |

| PENDING | REVIEW | Under review | Materials submitted; Checus reviewing, feedback expected in 0–3 business days. No action needed. |

| PENDING | TRANSMIT | Processing | Transaction in progress; wait for the final result. |

Error Codes

Error codes are grouped by scenario:

Category Description Server request limits Returned when frequency/IP rules trigger protection Merchant configuration Signature keys, contract activation, and other onboarding checks Order submission Parameter format, duplicate orders, system errors during submission Order validation Amount limits, beneficiary info checks, risk control restrictions Order query Errors related to the query API Error examples Synchronous response example (e.g., error when creating payout):

json{ "msg": "Invalid account or not active", "code": "INVALID_ACCOUNT" }Asynchronous callback example (e.g., transaction failed):

json{ "appId": "4701b0a908a14312b3c8452b448256dw", "code": "APPLY_SUCCESS", "data": { "transactionUtcTime": "2024-08-29T12:50:38 +0000", "status": "FAILD", "responseCode": "INVALID_ACCOUNT", "responseMsg": "Invalid account or not active" // other fields omitted }, "msg": "Success.", "notifyType": "PAYOUT" }Server request limit error codes

Code Description Notes REQ_TIME_OVER_TIME requestTime effective in two minutes Request time differs from server by >2m ILLEGAL_IP_REQUEST illegal ip request Request IP not in allowlist; contact Checus TOO_MANY_REQUEST Exceed request limitation, please retry later Rate limited; retry later Merchant configuration error codes

Subcategory Code Description Notes Signature/keys MERCHANT_APP_INVALID Signature key is not configured. Key not configured Signature/keys SIGN_VERIFY_FAILED The signature verify failed. Signature failed Contract/merchant CONTRACT_INVALID Merchant has not signed the contract or payment methods. Not contracted or methods not enabled Contract/merchant MERCHANT_INVALID The merchant has been offline. Merchant status issue Order submission error codes

Subcategory Code Description Notes Request validation PARAMS_INVALID The {field} is incorrect. Field format invalid Request validation ORDER_REPEAT The order number repeat. Duplicate order System error SYSTEM_ERROR System is busy, Please try again later. Try again later Order validation error codes

Subcategory Code Description Notes Payment method and amount limits PAYMENT_METHOD_NOT_AVAILABLE The payment method is not available. Payment method unavailable AMOUNT_LIMIT_UNMATCHED The amount does not meet the limit requirements Amount does not meet limits AMOUNT_NOT_ENOUGH Insufficient balance Insufficient balance Beneficiary account/info validation INVALID_ACCOUNT Invalid account or not active Invalid or inactive beneficiary ACCOUNT_BLOCKED Account blocked or frozen Account frozen INVALID_EMAIL Email address is incorrect. Invalid email format MISMATCHED_NAME Payee name does not match the account Name/account mismatch Sub-merchant info issues SUBMERCHANT_NOT_REGISTERED The subMerchantNo is not registered Sub-merchant not filed or incorrect SUBMERCHANT_REGISTRATION_FAILED The subMerchantNo registration failed Sub-merchant registration failed Risk control and others RFI_BLACKLIST Rejected due to failure of beneficiary to submit request information Compliance materials not submitted DECLINED_BY_RISK Beneficiary bank rejected credit Declined by risk control PAYMENT_FAILED Payment failed Payment failed Order query error codes

Code Description Notes ORDER_NOT_EXIST The order does not exist. Order does not exist or is processing