Disputes

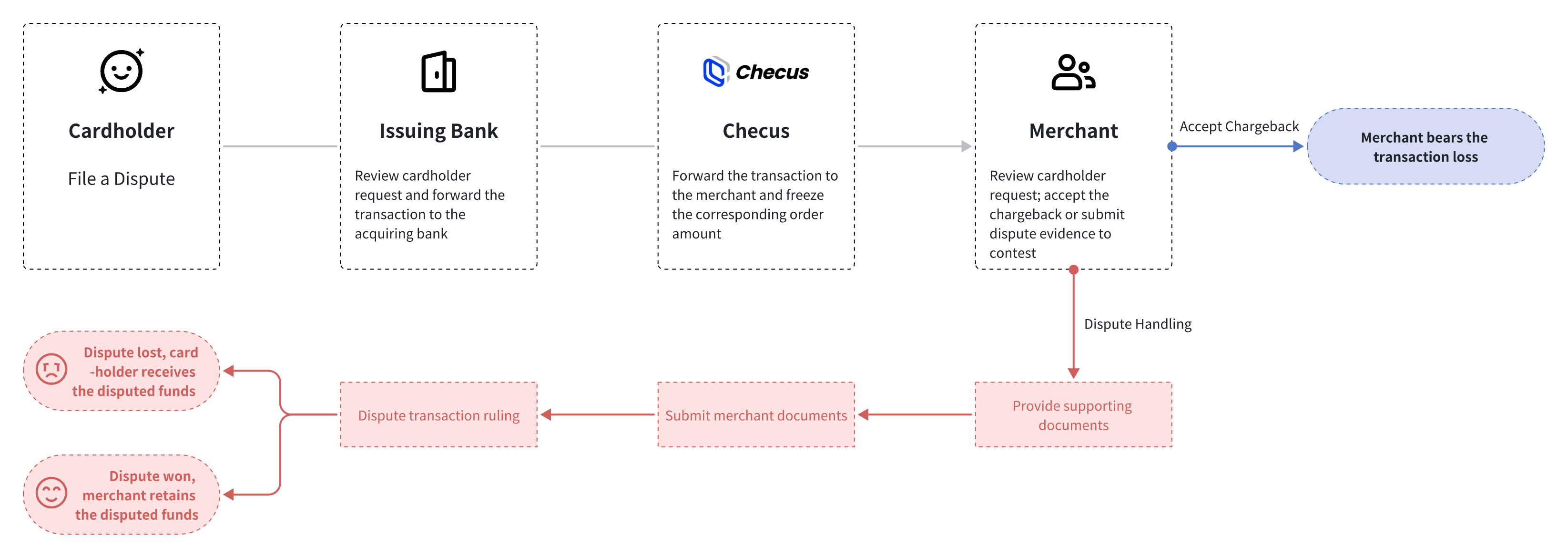

In online payment scenarios, transaction disputes are inevitable, especially when using credit card payments. Cardholders can raise objections to orders within a certain period (usually 180 days). Disputes may lead to chargebacks, where the issuing bank directly reverses funds after approval. You need to understand the process and risks in advance and respond promptly.Dispute Generation and Processing Path

Impact of Chargeback Orders

- Fund Freeze: Transaction amount is frozen, waiting for dispute resolution;

- Merchant Loss: If the appeal fails, the merchant not only loses revenue but also needs to bear chargeback fees and potential risk score increases.

Chargeback Type Classification

1. Fraudulent Chargeback

Unauthorized use of credit card by cardholder (such as card theft or fraudulent transactions)

2. Non-Fraudulent Chargeback

- Goods not received: Merchant did not ship or logistics issues

- Goods not as described: Physical goods don't match description, damaged, etc.

- Cancelled but not refunded: Buyer requested cancellation but did not receive refund

Dispute Status Description and Response Recommendations

1. Retrieval Request / Inquiry

- Meaning: Issuing bank requires merchant to provide transaction supporting documents.

- Merchant Response: Submit shipping documents, communication records, and other materials on time. If retrieval fails, it proceeds to chargeback stage.

2. First Chargeback

- Meaning: Cardholder raises dispute against transaction and gets support, issuing bank directly deducts funds.

- Merchant Response: Submit targeted materials for appeal based on chargeback reason, such as shipping documents, customer communication, service screenshots, etc.

3. Second Chargeback / Pre-Arbitration

- Meaning: Even if merchant's first appeal succeeds, cardholder can still raise disputes with different reasons again.

- Merchant Response: Treat as a new chargeback case, resubmit materials, and strive to dismiss again.

Second chargebacks usually still incur processing fees and cannot be refunded

Different payment channels/card organizations have different processes and limits