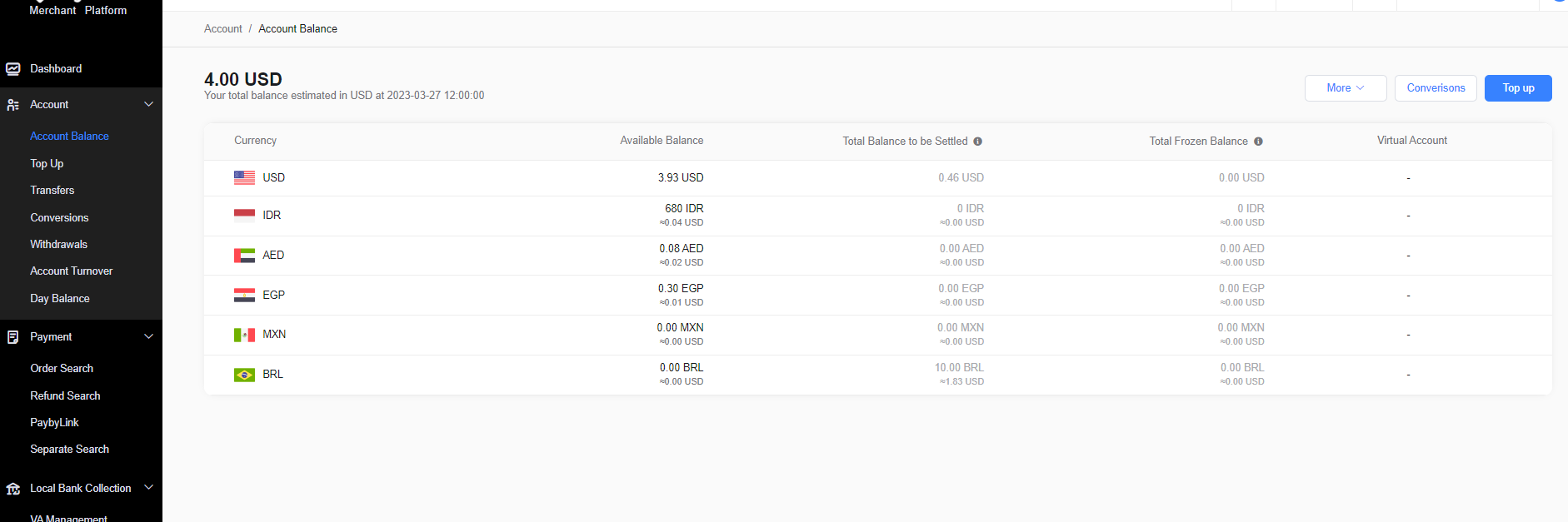

Account Balance

1. How to View Account Balance?

You can enter the Checus merchant platform "Account Management" - "Account Balance" menu to view the current account balance. All account amounts are converted to USD for display according to Checus exchange rates.

Note: 1. Account balance is only for reference when viewing balance and is not used as a settlement basis; 2. The USD unit balance of non-USD currency accounts is for display purposes only.

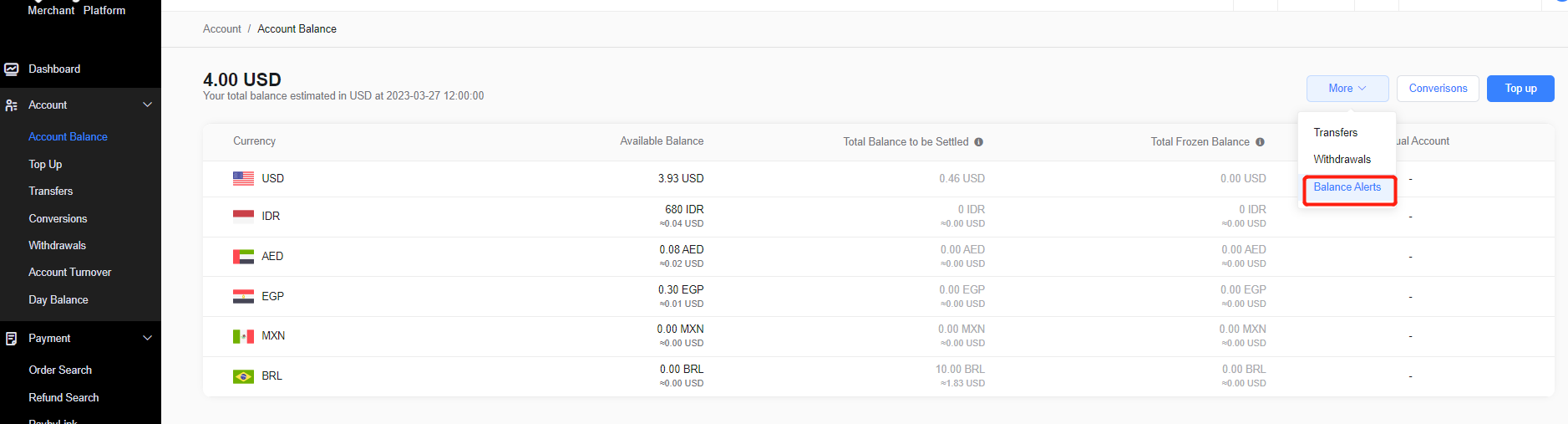

2. How to Avoid Affecting Merchant Payment Business Due to Insufficient Account Balance?

Merchants can use the [Balance Alert] function to prevent affecting payment business due to untimely top-up. Enter the merchant platform "Account Management" - "Account Balance" - "Balance Alert" to configure balance warning rules. When your account balance is less than or equal to the warning value, Checus will send an email notification. Regarding "Balance Alert", the warning amount only includes available balance and is a warning for each currency account amount, not for the total account balance.

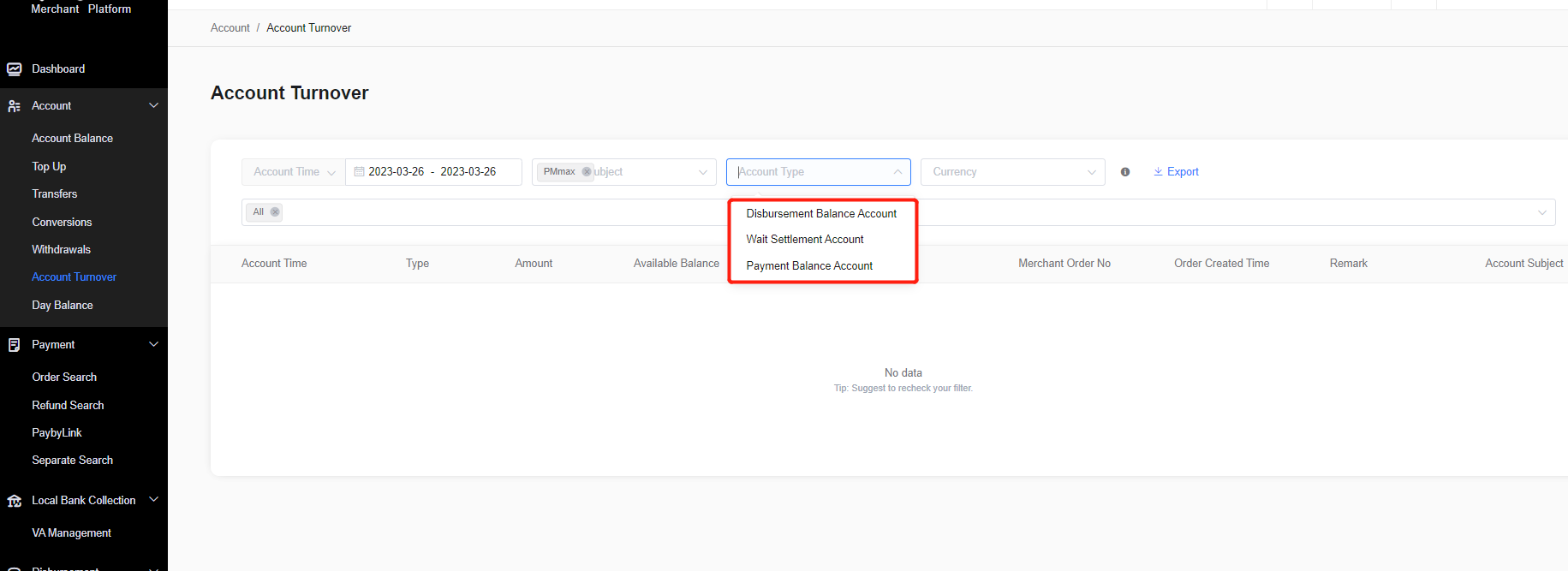

3. Account Type Introduction for Income and Expense Details

The merchant's income and expense details (path: MMC-Account Management-Income and Expense Details) involve fund movements in the following three accounts: pending settlement account, collection balance account, and payment balance account.  **Pending Settlement Account:** The amount after deducting handling fees and taxes from collection transactions. It can only be settled after reaching the settlement cycle (corresponding to the merchant's pending settlement account in the underlying logic) **Collection Balance Account:** Funds that have reached the settlement cycle and transferred from the pending settlement account to the collection balance account (corresponding to the incoming balance account in the underlying logic) **Payment Balance Account:** Funds obtained from merchant top-up or collection transfer to top-up

**Pending Settlement Account:** The amount after deducting handling fees and taxes from collection transactions. It can only be settled after reaching the settlement cycle (corresponding to the merchant's pending settlement account in the underlying logic) **Collection Balance Account:** Funds that have reached the settlement cycle and transferred from the pending settlement account to the collection balance account (corresponding to the incoming balance account in the underlying logic) **Payment Balance Account:** Funds obtained from merchant top-up or collection transfer to top-up

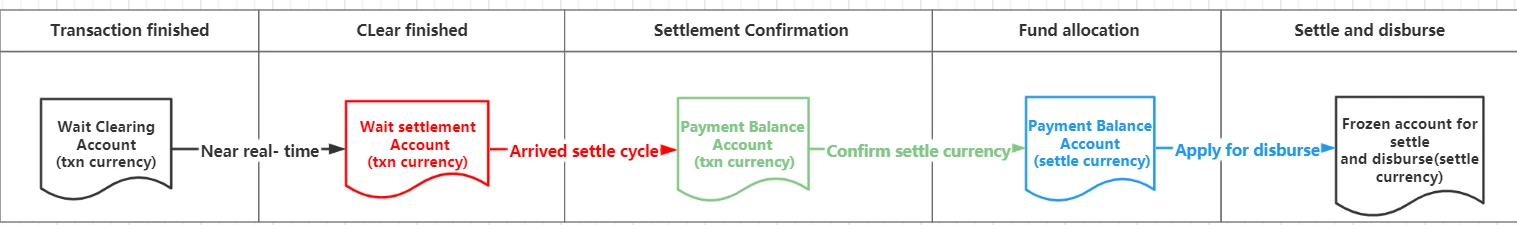

3.1. Collection Transaction Fund Flow Path (Underlying Accounting Logic)

**Among them, the transaction completion-pending clearing account is an internal Checus account, used only for Checus internal accounting.**

**Among them, the transaction completion-pending clearing account is an internal Checus account, used only for Checus internal accounting.** - After transaction completion: Funds enter the merchant's pending settlement account (transaction currency) —————— (merchant's pending settlement account balance increases)

- After reaching the settlement cycle: Funds transfer from the pending settlement account to the incoming balance account (transaction currency) —————— (merchant's pending settlement account and collection balance account balance increase/decrease equally)

- After merchant confirms settlement currency: Incoming balance account (transaction account) — confirm settlement currency — incoming balance account (settlement currency) —————— (merchant's collection balance account increases/decreases between transaction and settlement currencies)

- After applying for withdrawal: Funds settle and withdraw from the incoming balance account (settlement currency) —————— (merchant's collection balance account balance decreases)

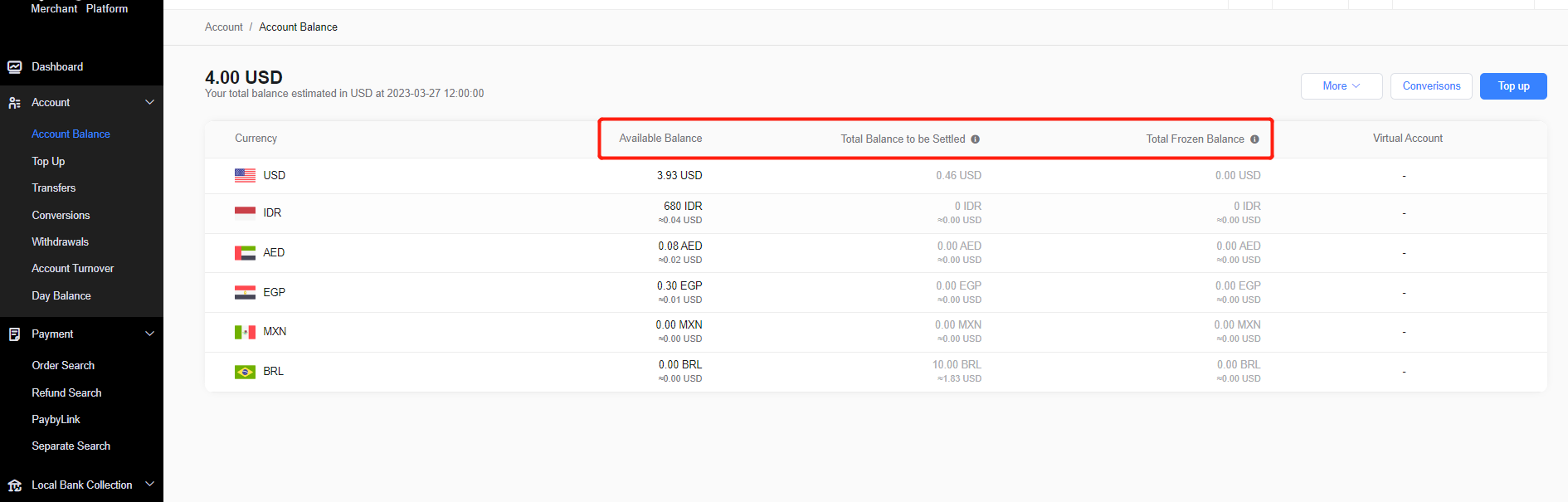

4. Account Balance Statistics Logic

The relationship between the amounts displayed on the account balance page and the various account types in the merchant's income and expense details is as follows:

The relationship between the amounts displayed on the account balance page and the various account types in the merchant's income and expense details is as follows: - Available Balance = Payment Balance Account

- Pending Settlement Amount = Pending Settlement Account + Collection Balance Account

- Frozen Amount Description: This is your frozen account amount, which is generally caused by user chargebacks or disputes. Business frozen amounts during the settlement withdrawal process are not included

5. Why is the Available Balance Inconsistent with the Actual Payment Amount During Top-up?

Checus currently only accepts USD deposits. After receiving the USD-calculated amount, Checus will convert it to the target currency according to the exchange rate agreed in the contract and top up to your available balance account. In various currency exchange operations, Checus will refer to our company's exchange rate system. For detailed information, please consult your business manager.

6. How is the Pending Settlement Amount Calculated? Why Doesn't it Match the Settlement Statement Amount?

(1) 'Pending Settlement Amount' is your collection transaction pending settlement amount, which displays the real-time amount of each currency at the query time point on the page. Note: The USD unit balance of non-USD currency accounts is for display purposes only. (2) The settlement statement amount is the actual USD-denominated amount when settling with you. The pending settlement amounts of various currencies that meet the settlement conditions (reaching settlement cycle, minimum settlement amount, business days) are converted to USD according to the exchange rate agreed in the contract and reflected in the settlement statement. In summary, the 'Pending Settlement Amount' display can only be used as a reference to view the approximate balance and cannot be used as a basis for settlement reconciliation. For collection transaction fund reconciliation, please refer to the settlement statement. For detailed information, please consult your business manager.

7. How to Top Up the Account?

Two methods:

Enter the merchant platform "Account Management" - "Account Top-up" channel, and follow the prompt steps to top up the account. See: Account Top-up

You can top up the account through settlement transfer to top-up operations. See Settlement Service