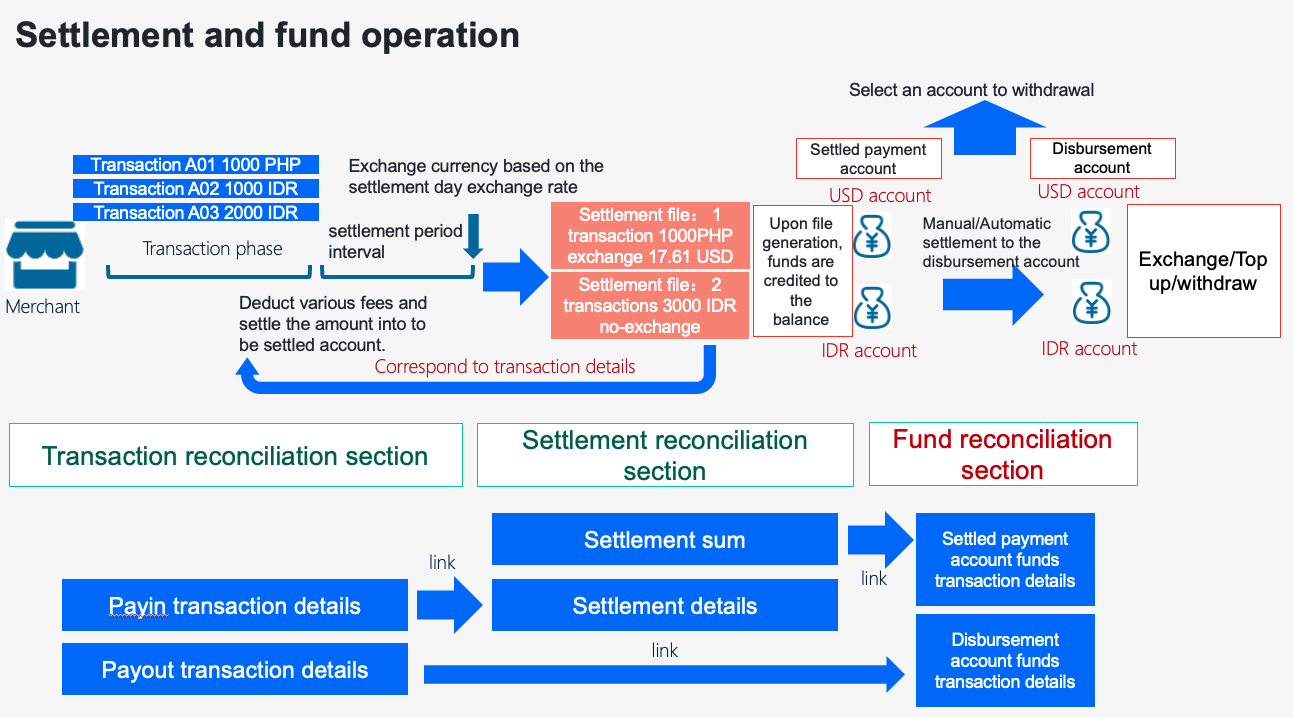

Settlement and Funds Flow Overview

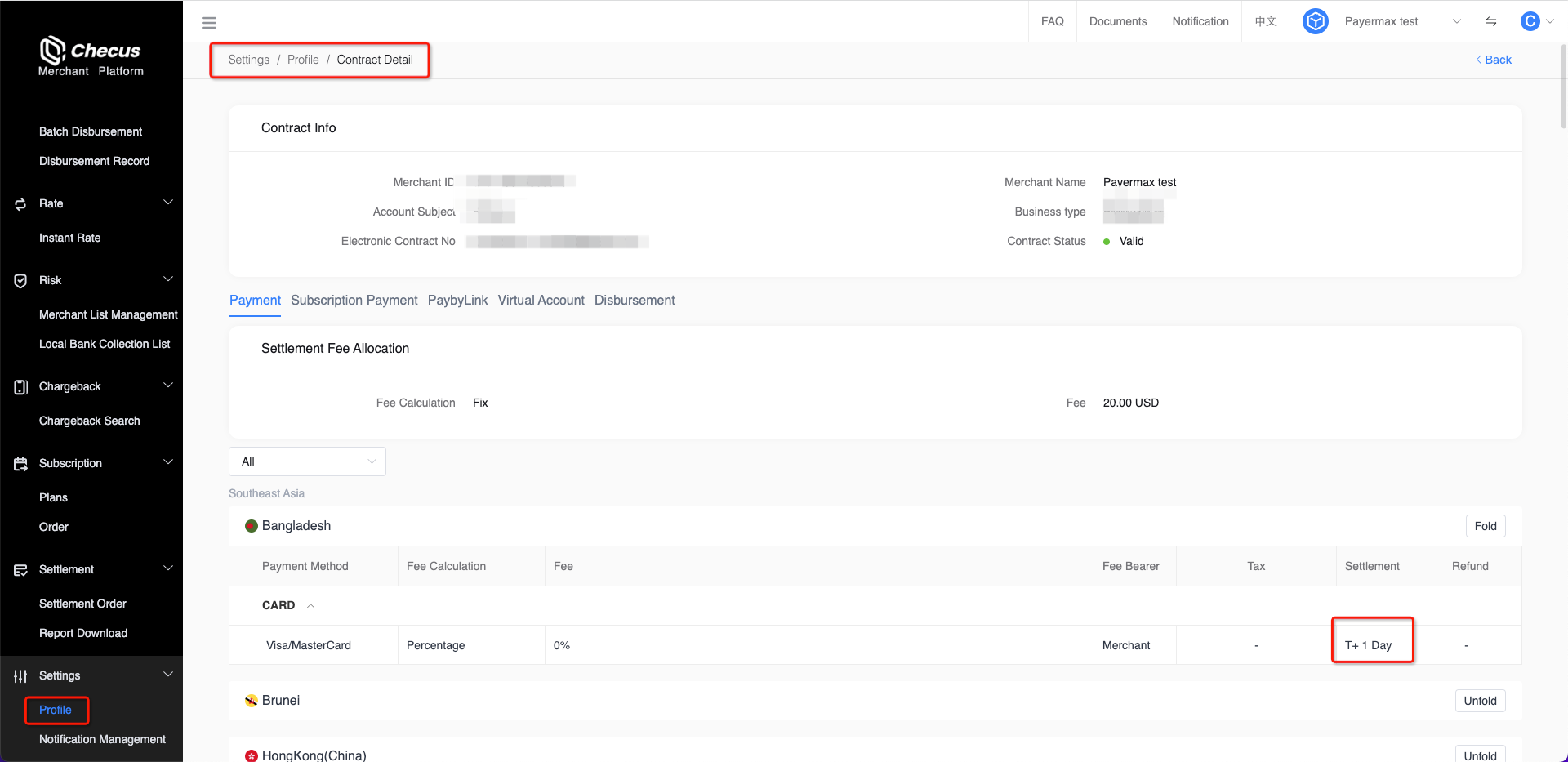

Step 1: Obtain the settlement cycle

You can view the Checus settlement cycle in the contract details on "Service Settings" → "Information Management".

● Wallet and bank card payment methods share the same settlement cycle, typically Monday of T+2 weeks.

● Carrier billing payment methods typically use a T+2 months settlement cycle.

If you have a specially approved settlement cycle, the platform will settle according to that specific cycle. We will also update the settlement billing-period features to help you better understand settlements on the Checus platform.

Step 2: Generate settlement statements

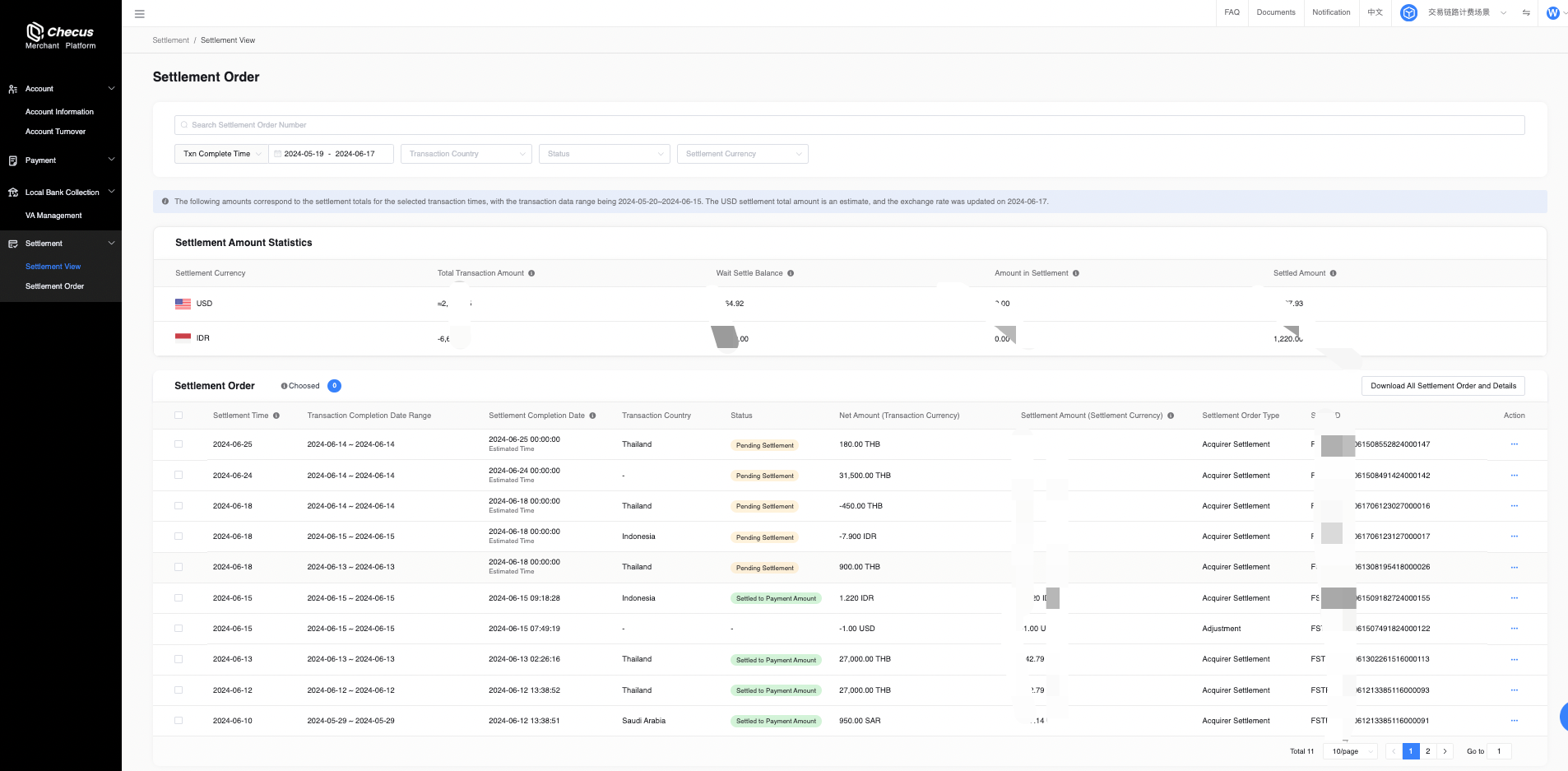

The system generates multiple settlement statements by the dimension of [Settlement Cycle × Transaction Country × Settlement Currency]. You can view them on "Settlement Management" → "Settlement View". The page supports querying settlement summaries by transaction completion time/settlement time, including settlement amount statistics within the time range, settlement date (billing date), settlement status, etc. You can select multiple statements to export a settlement summary and the corresponding settlement details.  Clicking a settlement statement opens its details, where you can view specific information including settlement amount, exchange rate, number of transactions, and the components of the amount calculation.

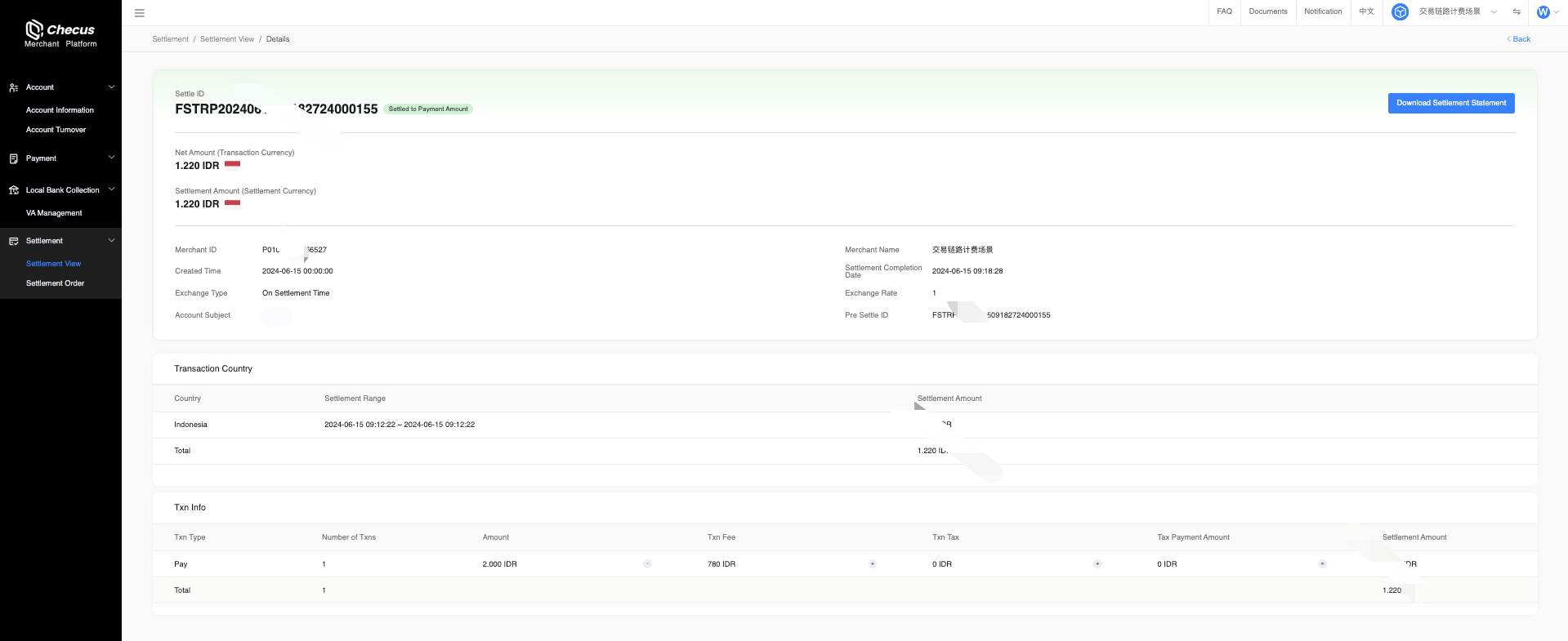

Clicking a settlement statement opens its details, where you can view specific information including settlement amount, exchange rate, number of transactions, and the components of the amount calculation.

Step 3: Query settlement funds

When a settlement statement is generated, funds are posted to the acquiring account (for merchants with combined pay-in/pay-out, local currency goes to the acquiring balance; for those without, funds are exchanged to USD and then posted to the acquiring balance). Funds are posted to the acquiring × currency account corresponding to each settlement statement's amount and currency. You can query specific fund movements on the Income & Expenditure Details page, as shown below:  Note: In the filters, select Account = Acquiring, Currency = All, Business = Settlement to view all settlement postings into balance.

Note: In the filters, select Account = Acquiring, Currency = All, Business = Settlement to view all settlement postings into balance.

Step 4: Operate on settlement funds

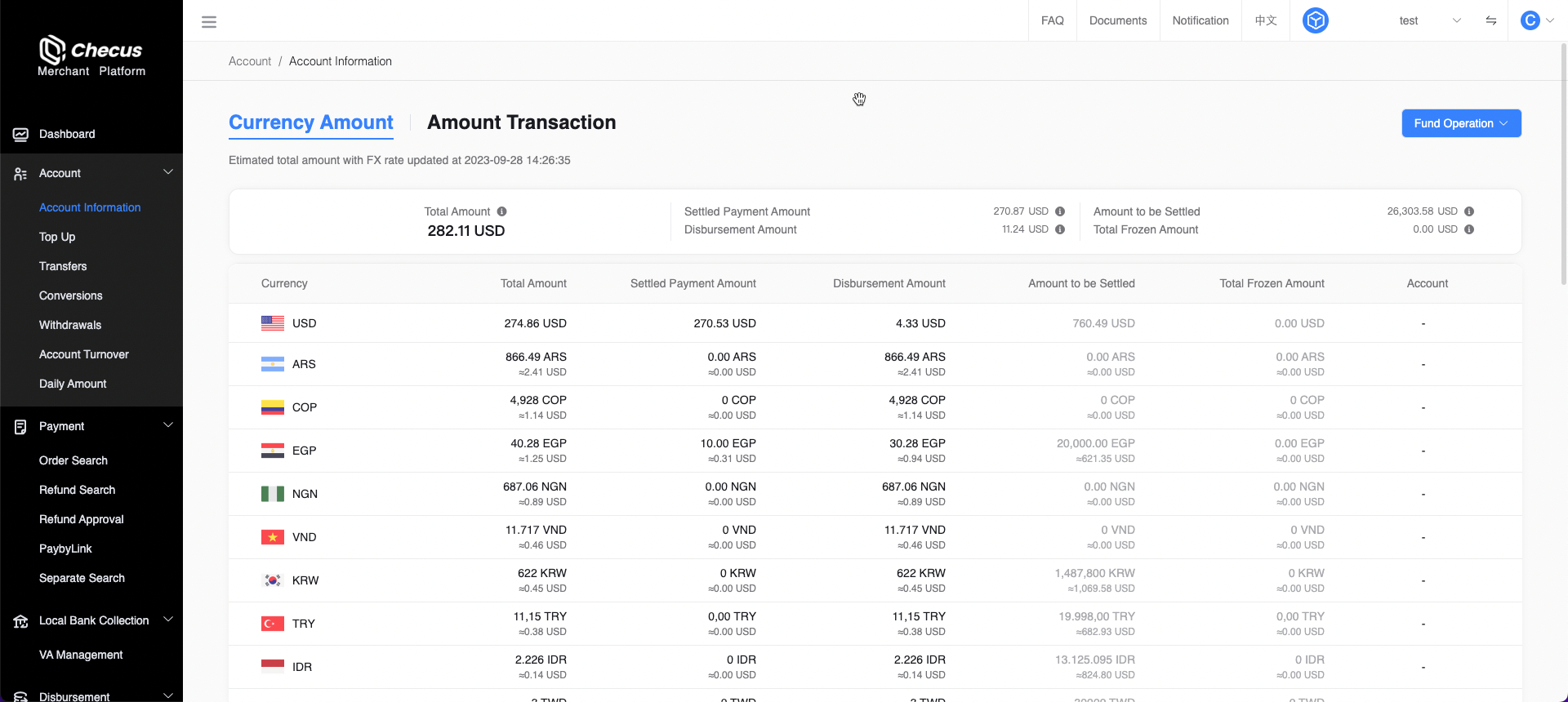

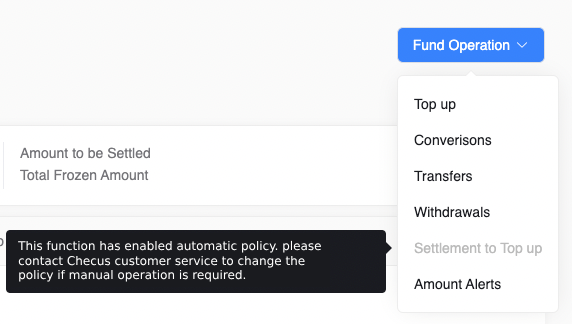

Go to "Account Management" → "Account Information" to view the actual amount in the acquiring account under [Acquiring Amount]. (This amount is an estimated USD value by converting all currencies at real-time rates; the actual balances remain in each currency account.) You can then perform [Settlement-to-Top-up] or [Withdrawal] on this acquiring amount.

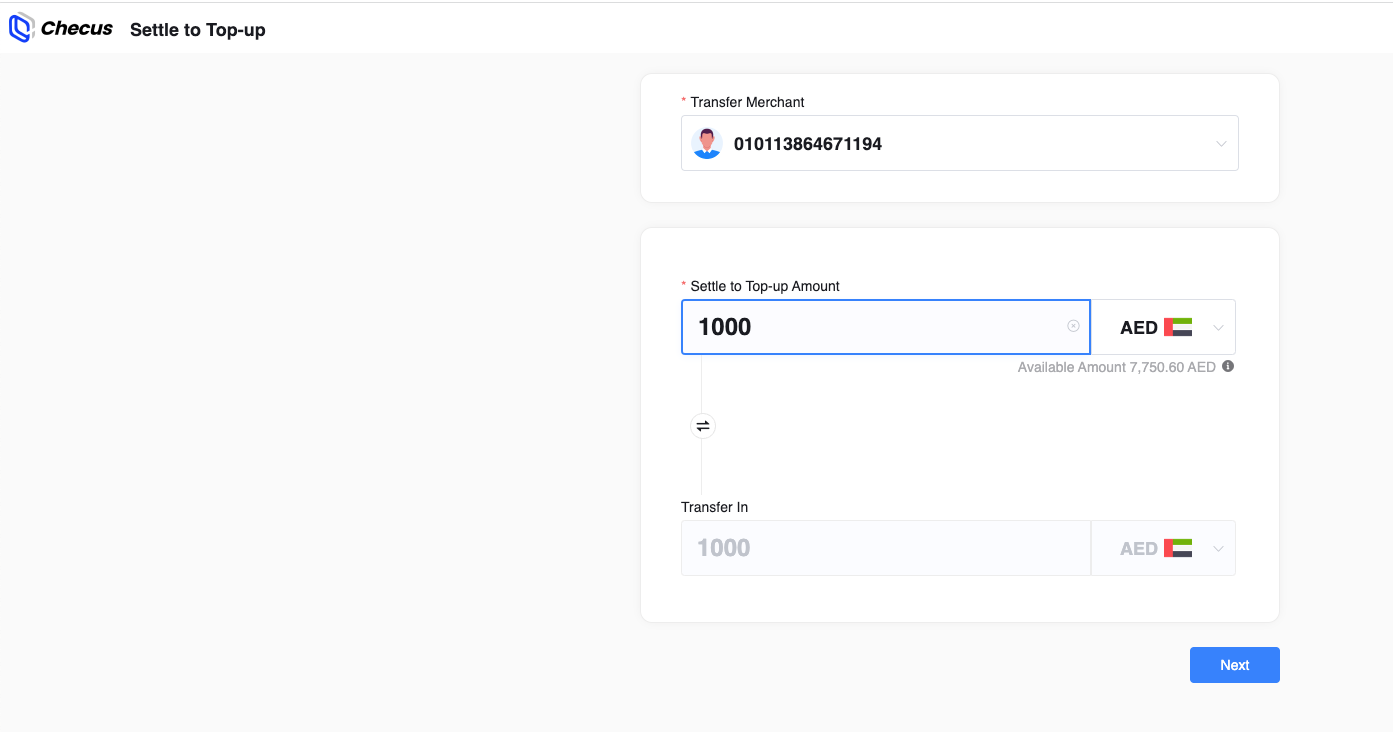

Settlement-to-Top-up: Click Settlement-to-Top-up under Fund Operations on the Account Information page to transfer acquiring funds to top up. You can transfer to the disbursement account of this merchant or to a disbursement account of another merchant under the same legal entity.  In the [Transaction Details] tab, you can currently view all Settlement-to-Top-up transactions.

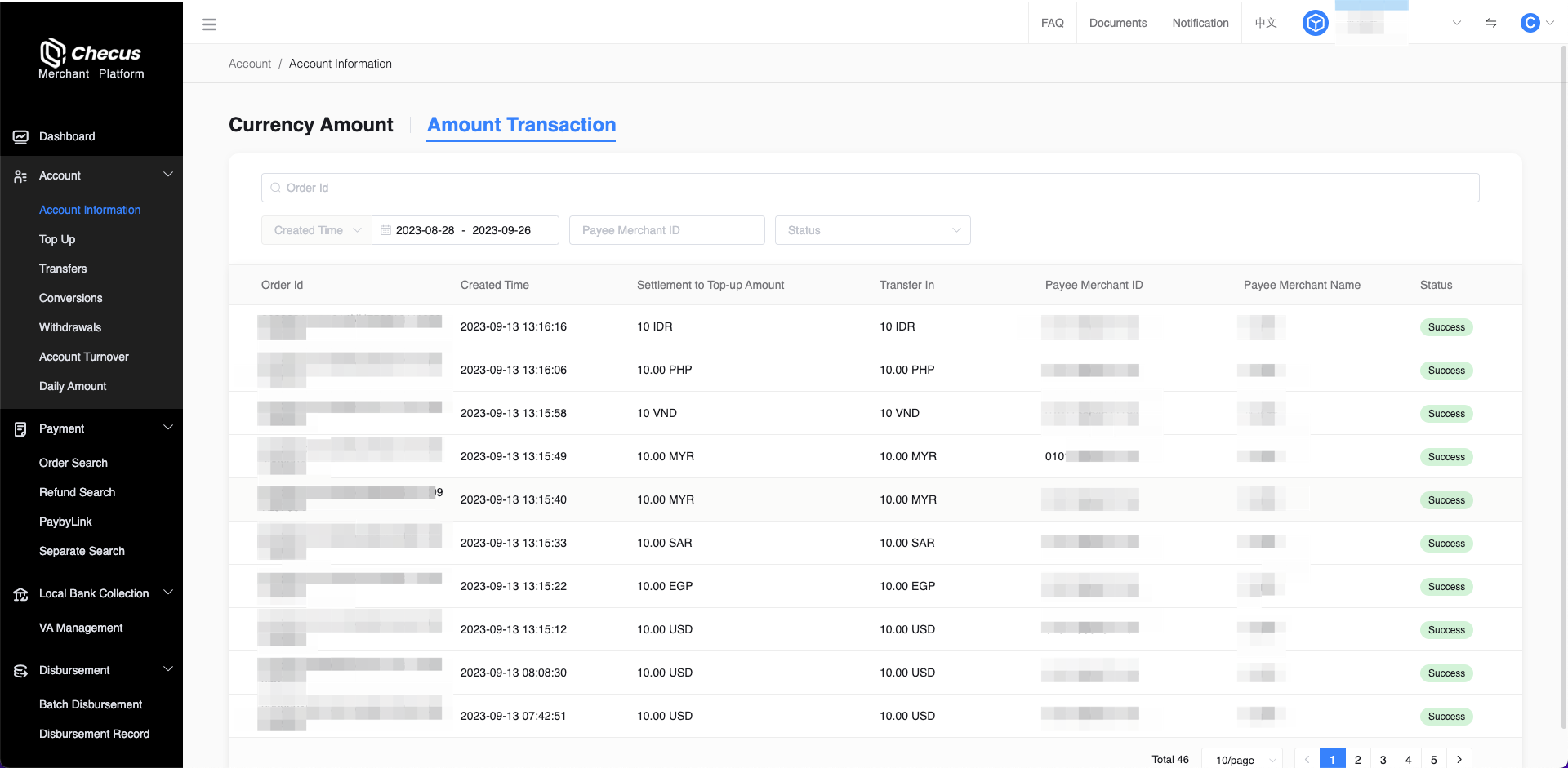

In the [Transaction Details] tab, you can currently view all Settlement-to-Top-up transactions.  Withdrawal: When initiating a withdrawal, if both the acquiring and the disbursement accounts have balances and are operable, you will be prompted to choose the account after clicking Withdraw.

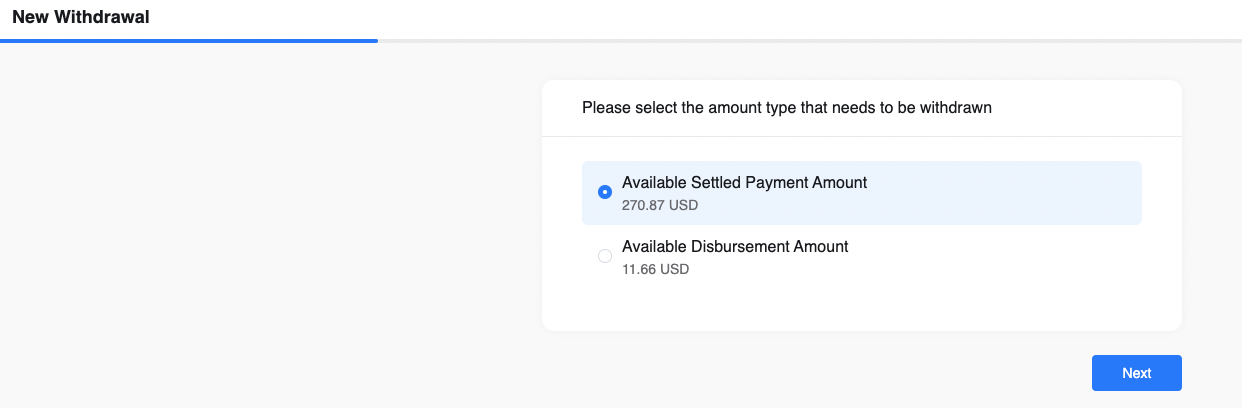

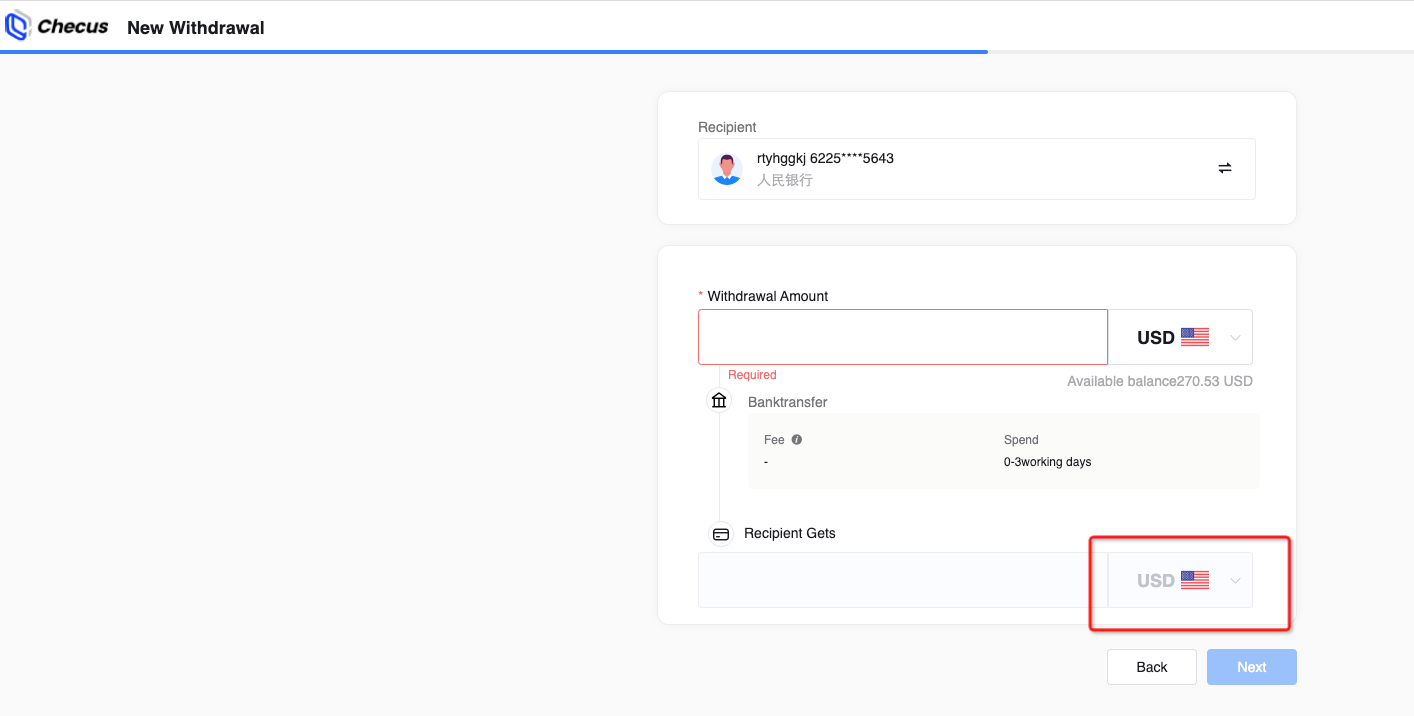

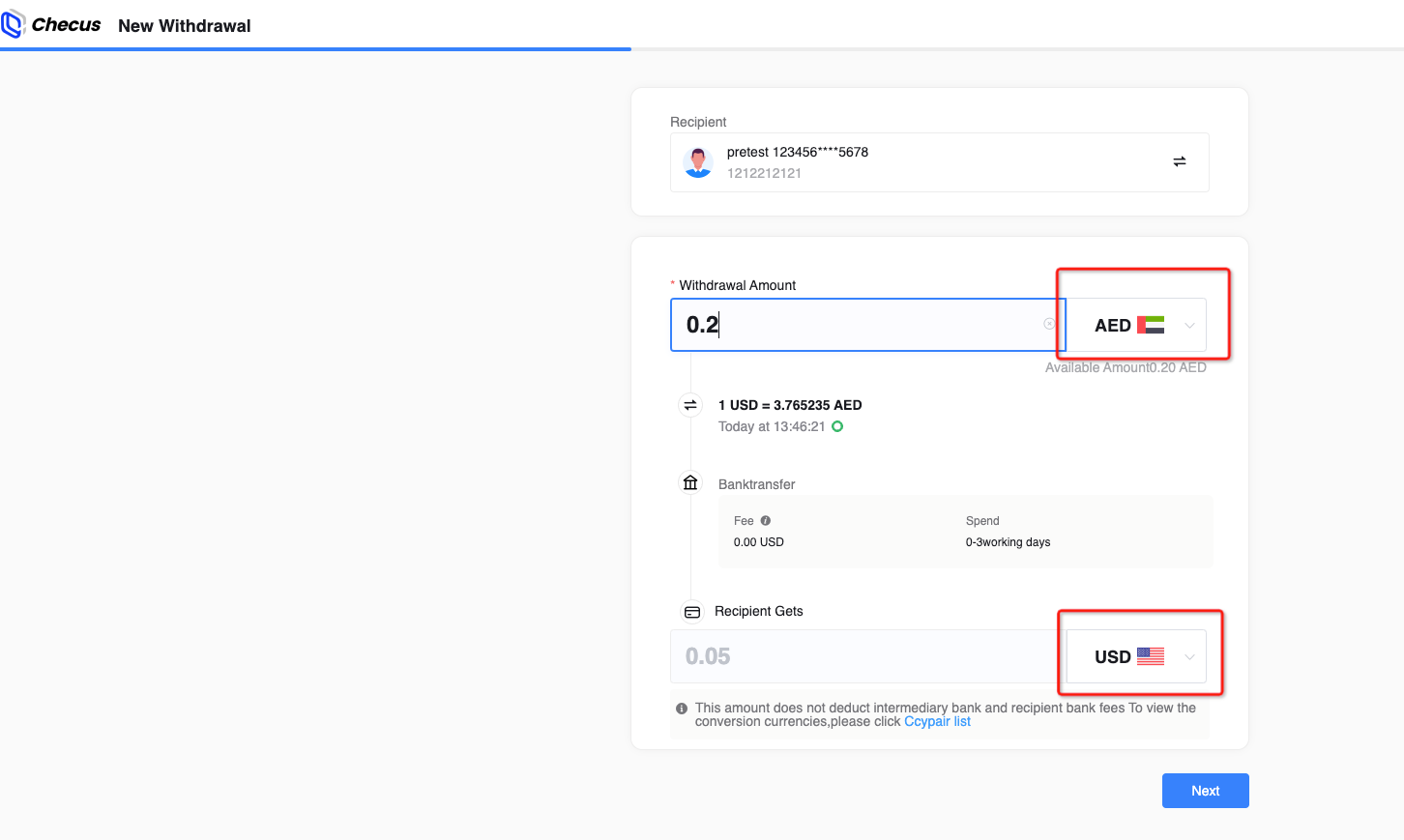

Withdrawal: When initiating a withdrawal, if both the acquiring and the disbursement accounts have balances and are operable, you will be prompted to choose the account after clicking Withdraw.

- If you choose to withdraw from the acquiring account, only same-currency withdrawals are supported. If the settlement currency does not support withdrawal, you can first perform Settlement-to-Top-up to the disbursement account and then exchange and withdraw.

- If you choose to withdraw from the disbursement account, you can withdraw in a different currency and complete FX during withdrawal. Funds in the disbursement account are generally obtained via Settlement-to-Top-up, Top-up, or VA collections.

● If all your currencies have enabled automatic Settlement-to-Top-up from the acquiring balance or automatic settlement to bank card, the Settlement-to-Top-up button will be disabled.

● If all your currencies have enabled automatic Settlement-to-Top-up from the acquiring balance or automatic settlement to bank card, the Settlement-to-Top-up button will be disabled.

● If some currencies have enabled automatic Settlement-to-Top-up from the acquiring balance or automatic settlement to bank card, those currencies cannot be selected during Settlement-to-Top-up or Withdrawal.

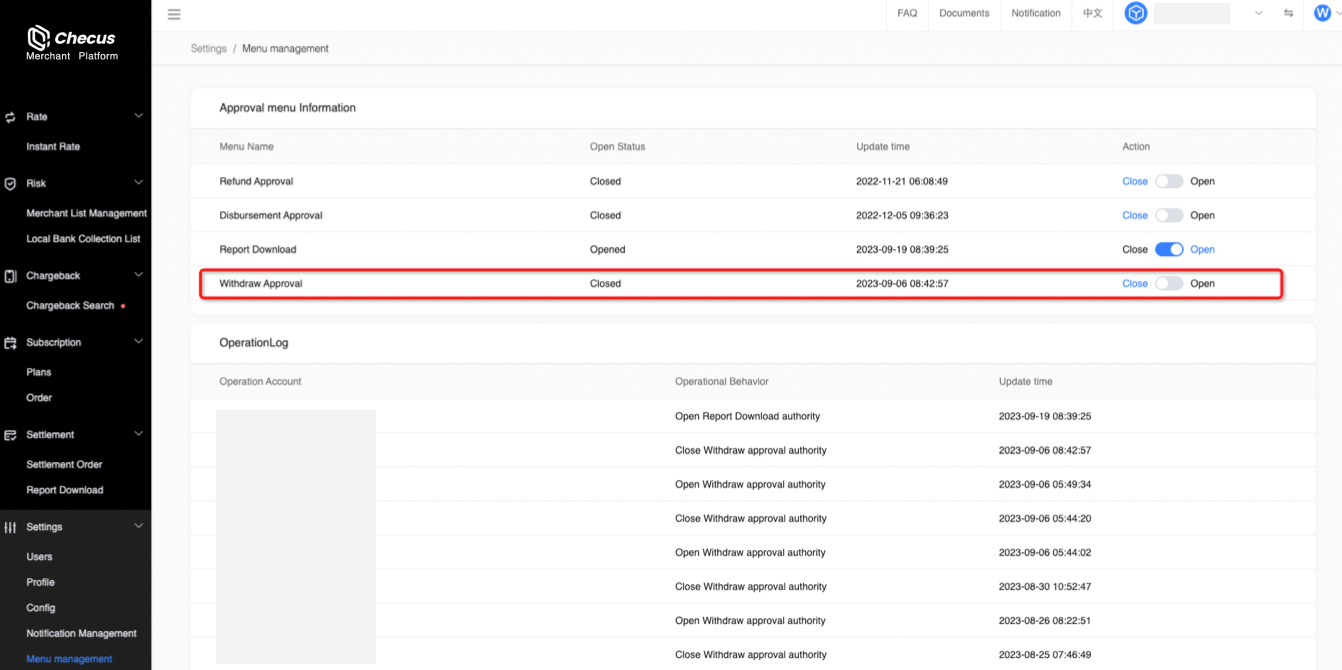

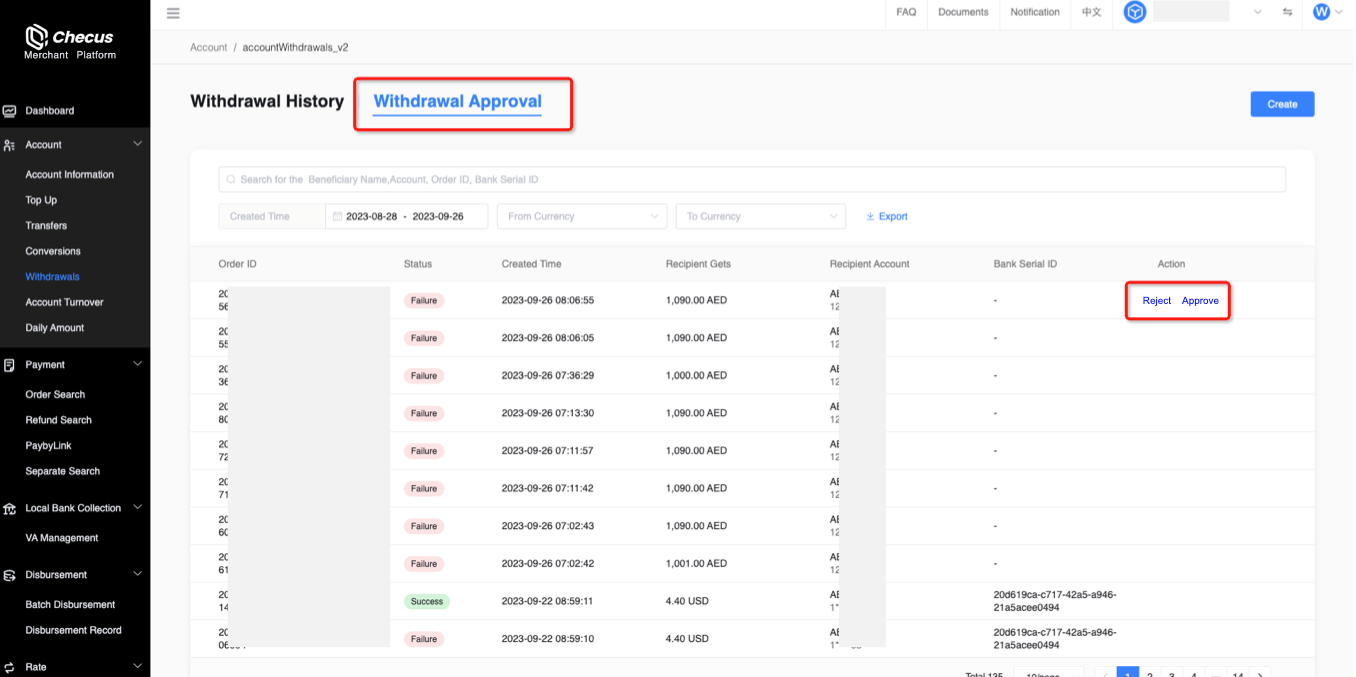

If you require control and approval over fund operations, you can enable [Withdrawal Approval] on the Settings → Menu Management page.  After enabling [Withdrawal Approval], an approval tab appears on Account Management → Withdrawal. All withdrawals based on acquiring balances will require withdrawal approval by an administrator or operators with approval permissions before the final withdrawal is executed.

After enabling [Withdrawal Approval], an approval tab appears on Account Management → Withdrawal. All withdrawals based on acquiring balances will require withdrawal approval by an administrator or operators with approval permissions before the final withdrawal is executed.

FAQ

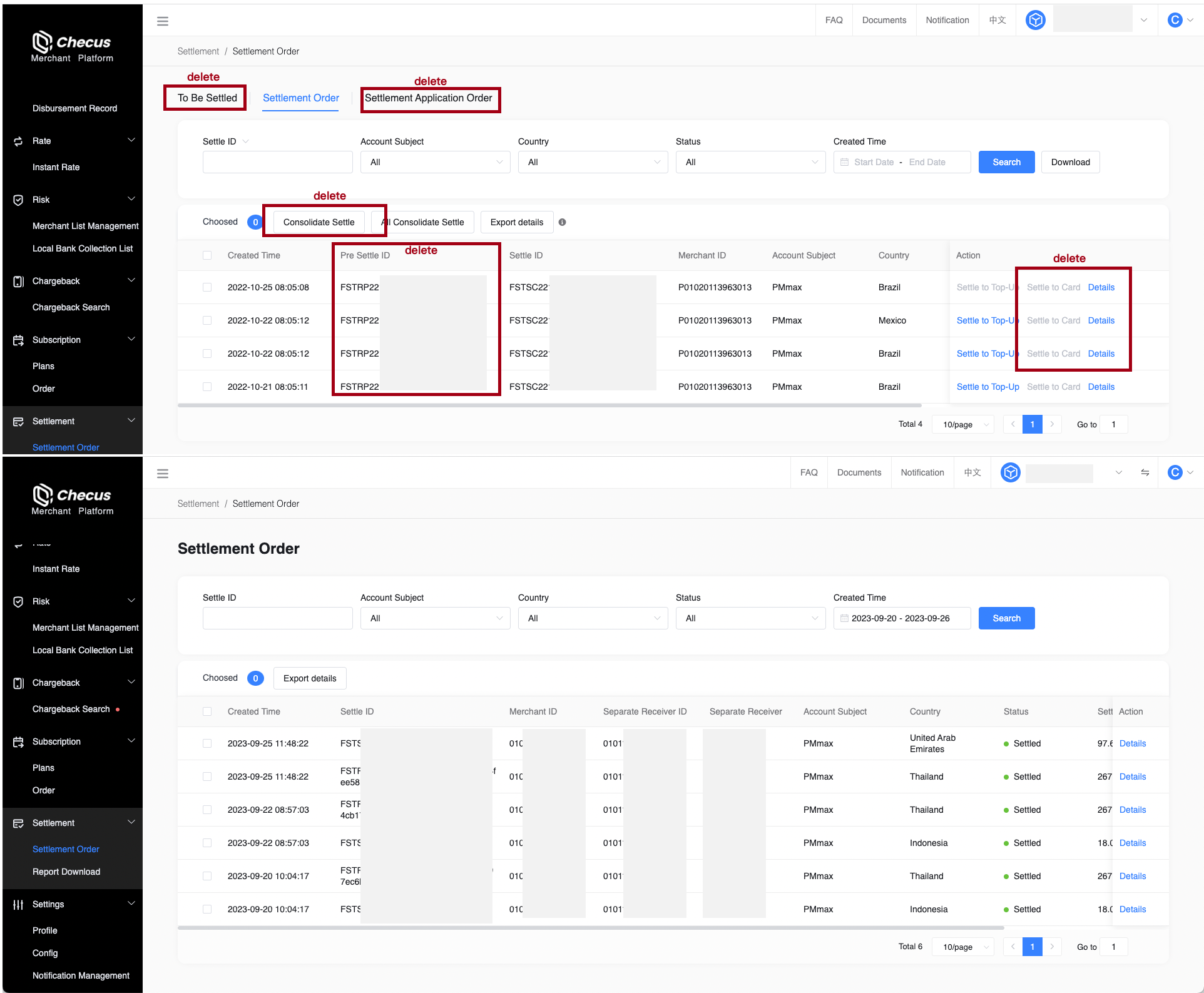

1. Why does my Settlement page look different from the screenshots?

The Settlement page has been upgraded. Changes include:

● Pre-settlement and settlement are merged; the [Pending Settlement] tab is removed.

● [Merge Settlement] and [Settle All] buttons are removed.

● For individual settlement statements, [Settlement-to-Top-up] and [Settle to Bank Card] are removed.

● The [Settlement Application] tab is removed (since settlement statements no longer serve fund operation purposes, withdrawal approval has moved to the Funds Withdrawal page).

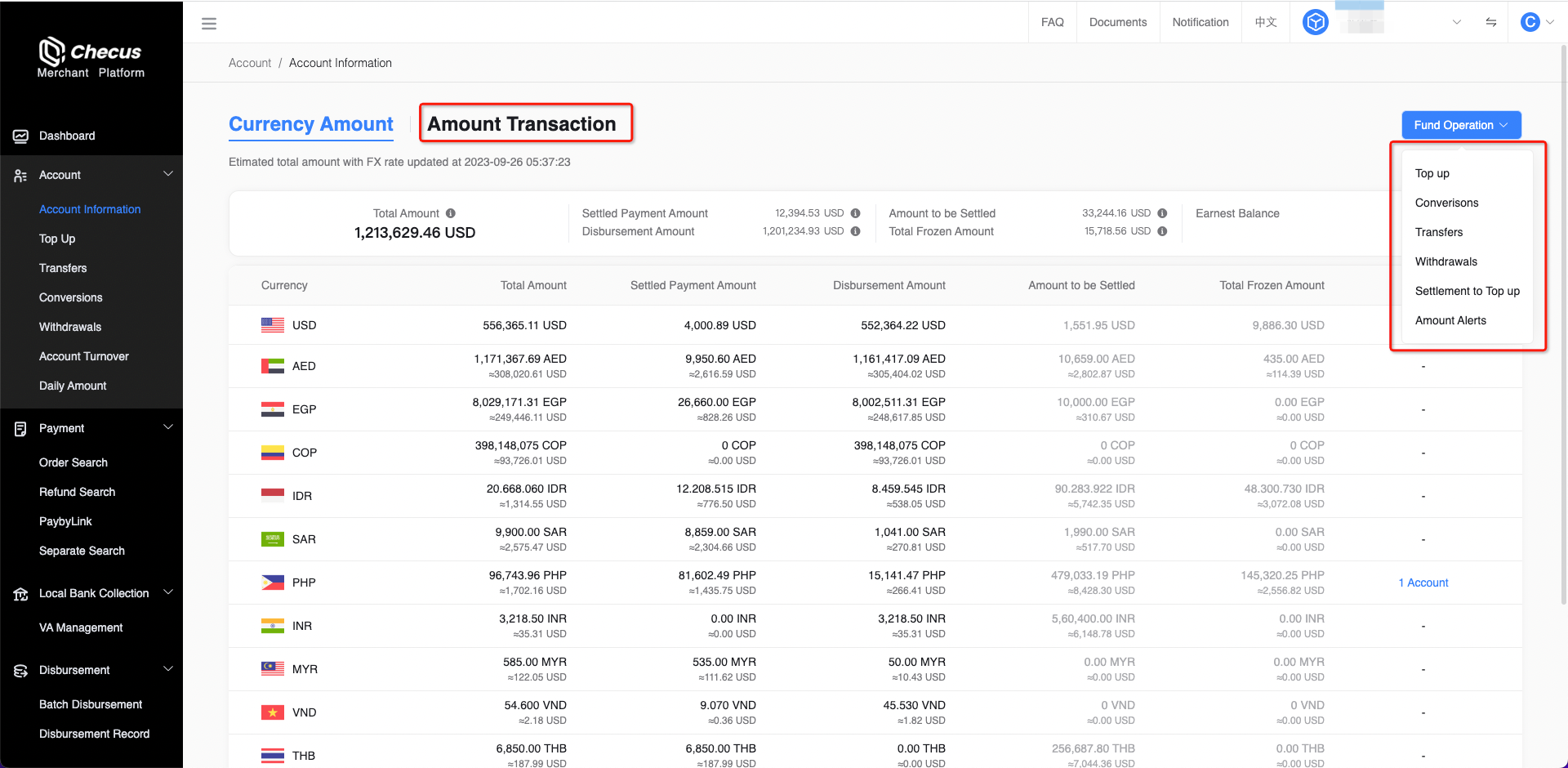

2. Why does my Account Information page look different from the screenshots?

Key changes to the Account Information page:

● Added Settlement-to-Top-up under Fund Operations

● Top-up, FX, Transfer, Withdrawal, Settlement-to-Top-up, and Balance Alert are combined under the Fund Operations dropdown

● Top-up, FX, and Transfer apply only to disbursement account funds; Settlement-to-Top-up applies only to acquiring account funds; Withdrawal can be performed from either acquiring or disbursement account funds

● Added a [Transaction Details] tab where all Settlement-to-Top-up transactions are currently recorded (subsequently, Top-up, FX, Transfer, and Withdrawal transaction details will also be consolidated into this tab).

3. How can I learn about settlement progress?

Email notifications How to receive settlement emails

- When a settlement statement is generated, funds are posted directly to the acquiring account and you will receive an email notification from us. Please monitor account balance changes.

Proactive query How to apply for Merchant Portal access

- Log in to the Merchant Portal and go to "Settlement Management" → "Settlement Statements" to check the status of current settlements, or go to "Income & Expenditure Details" to check fund movements in the acquiring account.

4. Why haven't I received remittance after initiating a withdrawal?

Please confirm the following:

● Has a withdrawal request been submitted?

● Does your contract specify a minimum settlement threshold, i.e., statements below the threshold will not be settled?

● If banks suspend services during local holidays, the transfer time will be postponed. We will send you a notification email after settlement is completed.

5. How do I change my withdrawal bank account information?

Please provide your settlement bank account information during KYC. If you need to change it, contact your account manager or email

support@checus.com with the required documentation.

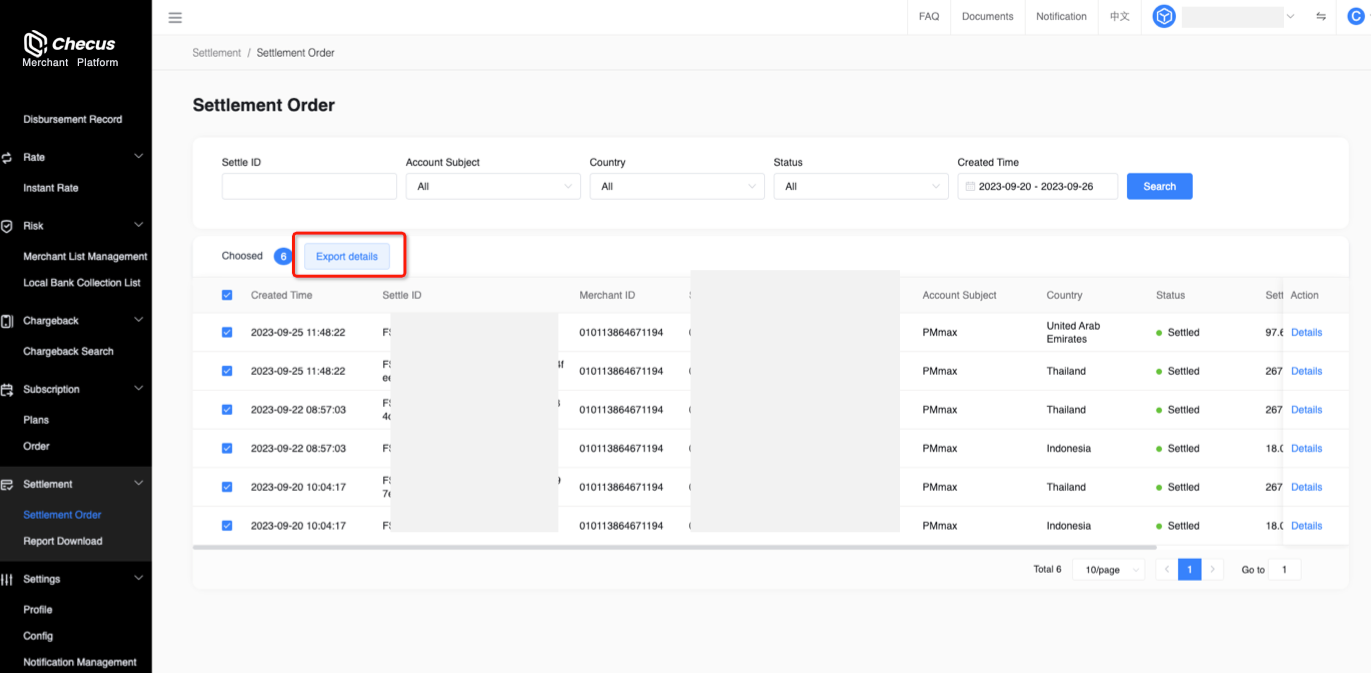

6. How to bulk export settlement statements?

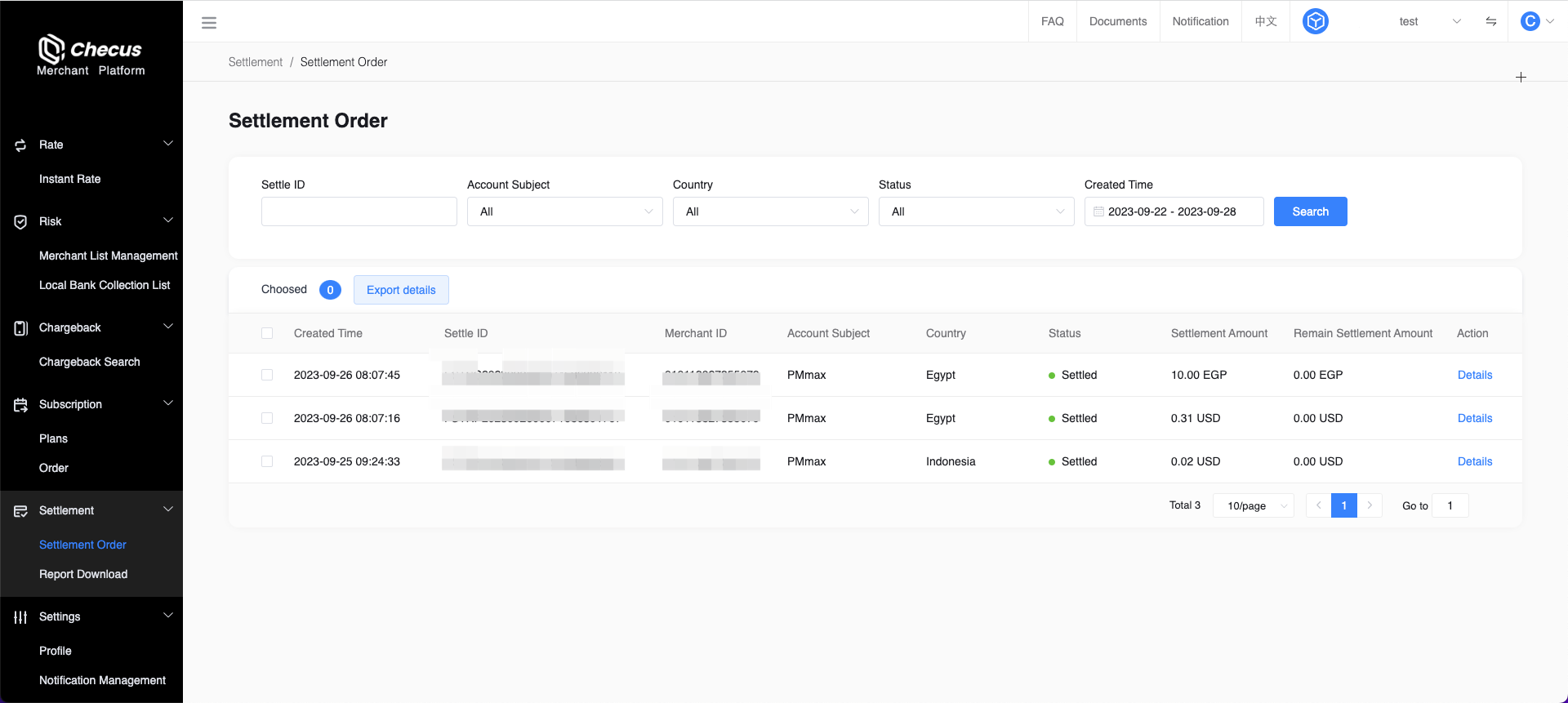

On the Settlement Management → Settlement Statements page: after filling in the filters, click "Export Details" to export the statements under the current filters as a summary sheet for statistics and analysis. The export also includes detailed settlement items to clarify which transactions were combined into each settlement. When exporting, you can customize the time zone; all times in the statements will be converted to the selected time zone.

7. What are settlement/withdrawal fees?

Settlement fees are the charges deducted when merchants withdraw, based on the actual number of remittances. For details, consult your account manager.

8. What exchange rate is used for cross-currency settlements?

Exchange rates fluctuate in real time. For details, consult your account manager.

9. How to receive settlement notification emails? How to customize recipients?

We send settlement notification emails to the Merchant Portal super administrator and the "Finance" contact to inform them of settlement progress. Finance email configuration example: